Car Insurance

From third party to fully comprehensive. We can tailor your car insurance policy to suit you.

Car insurance doesn't need to be complex. Our experts are on hand to provide the best insurance solution foryou.

Car insurance is where we started over 30 years ago! It was the beginning of who we are today. We’re proud of the team we are and the expert advice we can offer.

Our Levels of Cover

We can offer varying levels of cover, depending on your requirements. Fully comprehenisve offers the most complete protection. It’s worth bearing in mind that this level of cover can be just as competitively priced as the other levels.

Third Party

If you are involved in an accident that was your fault, insurers will pay for damage/injury caused to other people and their property. This does not include damage to your own car. This is often the cheapest cover and is the minimum level of cover required by law.

Third Party, Fire & Theft

In addition to third party only cover, this next level will protect your vehicle from damage caused by fire, theft and any third party claims if you’re involved in an incident.

Fully Comprehensive

This is the highest level of cover. As well as including third party, fire and theft it also covers the costs of repairing or replacing your own vehicle if it is vandalised or involved in an incident. Additionally, things such as breakdown, windscreen damage and driving abroad can be included.

What’s Covered with Fully Comprehensive Car Insurance?

Fully comprehensive is the most complete car insurance policy. The majority of scenarios will be covered from, write-offs to lost keys. Here are a few of the key features:

- NEarn No Claims Discount (NCD)

- NWindscreen repair and replacement

- NReplacement locks & keys

- NAccidental damage

It’s not just standard car insurance we offer…

The relationships we have with insurers means that we are rarely limited on what we can cover. From learner drivers, to London buses!… We will take time to talk to you and find out exactly what you need. From there, we will go to market and source a policy tailored to your needs.

Electric Cars

Learner Drivers

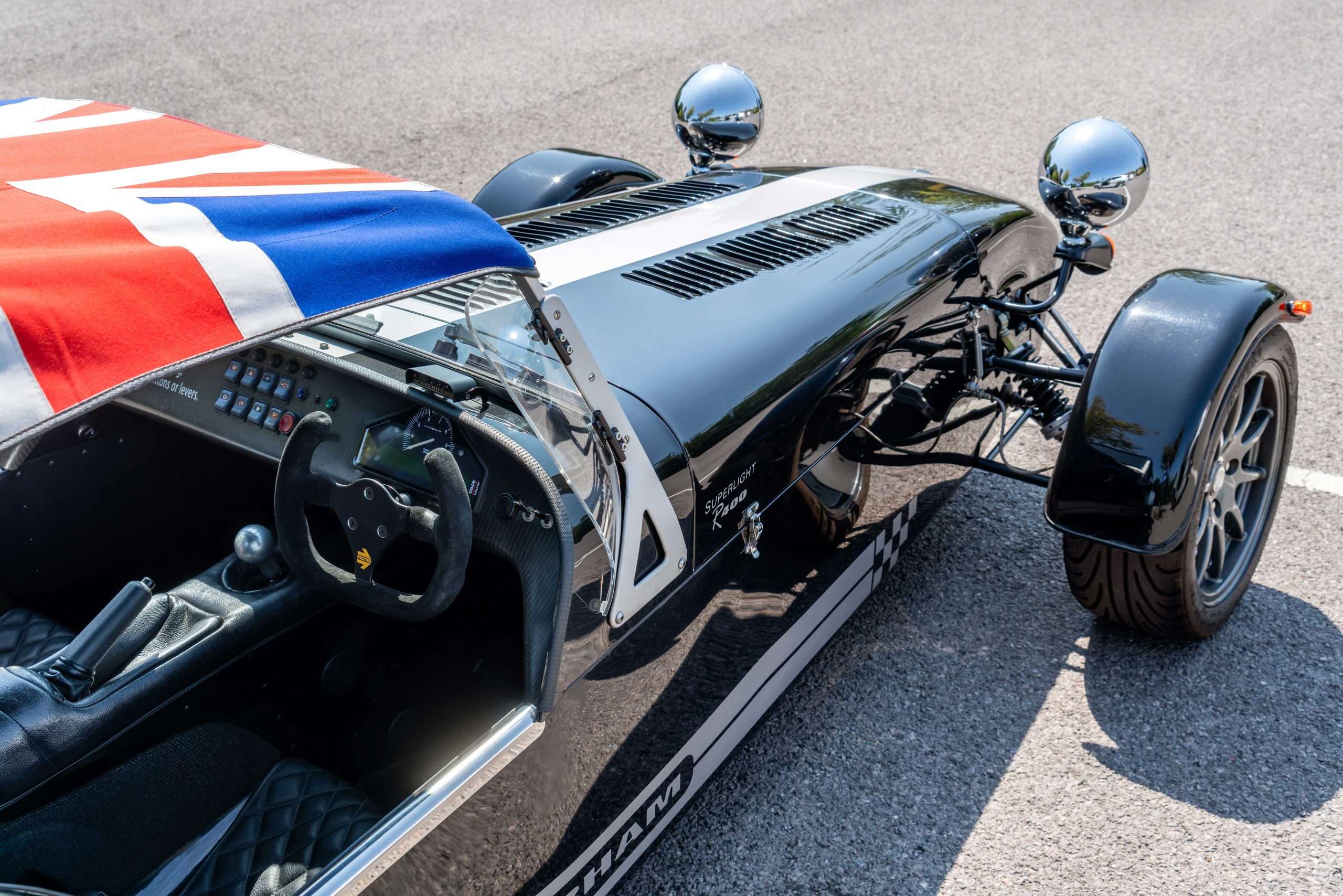

Classic Cars

What Isn’t Covered?

There are some scenarios that are not generally covered by your car insurance. Sometimes, cover may just not be available. Other times, we may have to add elements onto your policy to suit your needs. Here are a few examples:

- MDrivers that are not named on the policy

- MMechanical or electrical breakdown

- MVehicles stolen as a result of negligence i.e. open windows or keys left in the immediate proximity

- MModifications that we have not been made aware of

Optional Car Insurance Extras

There are some scenarios that are not generally covered by your car insurance. Sometimes, cover may just not be available. Other times, we may have to add elements onto your policy to suit your needs. Here are a few examples:

- Legal Expenses

- Hire Car

- Protected No Claim Discount (NCD)

- Breakdown Cover

- Excess Protection

Frequently Asked Car Insurance Questions

Where can I find my policy documents?

We will email your policy documents to you once your policy is live/renewed. Should you need us to send them to you again, please give our personal lines team a call on 0333 222 1030.

How much is car insurance?

The cost of car insurance will vary and depends on various factors such as your age, the type of car you drive and where it is kept. We have access to a wide market where we can obtain competitive premiums with a policy tailored to your needs. Get in touch on 0333 222 1030 where one of our experts will be on hand to help you.

How do I request proof of my no claims?

Proof of no claims is usually sent to you. But if you want to speak to a member of our team, get in touch on 0333 222 1030.

Can I add someone else to my policy?

Yes no problem. Additional drivers can be a permanent or temporary addition. Just give us a call and we will make the amendments to your policy; 0333 222 1030.

Is there a fee for making changes to my policy?

Yes, a small fee will be applied when we carry out a Mid Term Adjustment (MTA) for you on your policy.